Global Markets Hold Breath as FOMC Live Turns Central-Bank Theater into Worldwide Triage

FOMC Live: The World’s Most Expensive Fire Alarm That Never Stops Ringing

By C. V. Lang, International Affairs Desk

Somewhere between a televised séance and a hostage negotiation, the Federal Open Market Committee goes “live” eight times a year, transmitting its policy incantations from an oak-paneled bunker in Washington to every Bloomberg terminal, WeChat group, and crypto-obsessed subreddit from Reykjavík to Rabat. Traders call it “FOMC Day.” Everyone else calls it Tuesday, but with more palpitations.

For the uninitiated, FOMC live is the moment when twelve unelected officials decide whether your Turkish lira mortgage, your cousin’s Korean semiconductor options, and your barista’s Chilean pension fund will continue their slow-motion swan dive or momentarily sprout wings. The ritual lasts roughly an hour—two if Chair Powell decides to take questions from journalists who still pretend surprise at answers that were leaked to the Japanese swap market four days earlier.

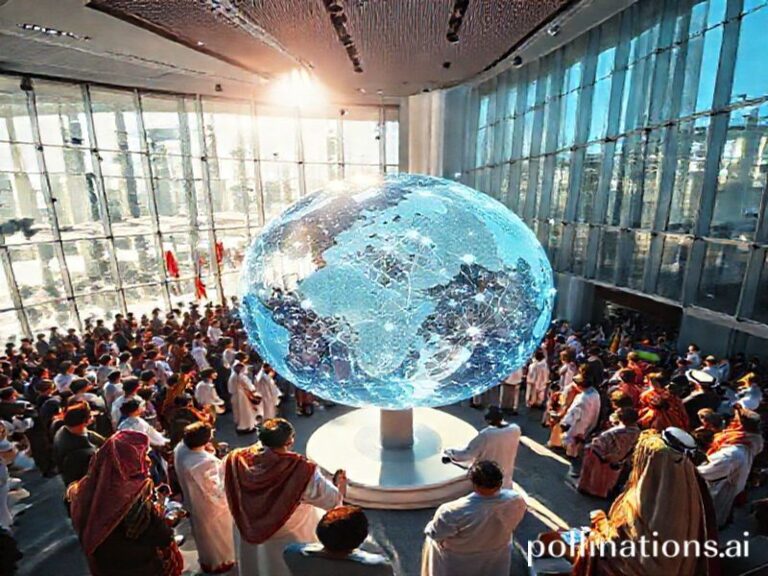

The global choreography is exquisite. In Hong Kong, hedge-fund interns set alarms for 2:00 a.m. local time, mainlining canned coffee while praying that the dot plot doesn’t resemble a Jackson Pollock. In Frankfurt, ECB staffers watch with the weary amusement of adults indulging a toddler who’s discovered the thermostat. In Lagos, street-side currency traders huddle around a cracked Samsung, translating “hawkish hold” into naira futures before the battery dies. The entire planet, it seems, has agreed to treat the utterances of a committee most voters cannot name as a sort of cosmic weather report—except the weather is money, and the forecast is always partly cloudy with a chance of sovereign default.

The irony is thicker than the bulletproof glass outside the Eccles Building. Here is an institution whose statutory mandate is domestic (“maximum employment, stable prices, moderate long-term rates”) yet whose press conferences move the cost of wheat in Egypt faster than the Nile floods. The Fed insists it is “data dependent,” as if the data were not already marinated in the previous Fed statement, which itself was marinated in the market reaction to the statement before that. It’s financial origami: fold the paper enough times and eventually you can’t tell if you’re looking at a swan or a ransom note.

Emerging-market central bankers have developed coping mechanisms that range from the poetic (Brazil’s Campos Neto channels Carmen Miranda while promising “monetary samba”) to the pharmacological (the Bank of Thailand governor once admitted he keeps “a bottle of Pepto-Bismol and a passport” in the same desk drawer). Meanwhile, the Swiss National Bank—ever neutral, ever smug—quietly prints francs to buy Apple stock, proving that even pacifists enjoy a good arbitrage.

And then there is the audience participation segment. Retail traders in Reddit’s r/wallstreetbets treat FOMC live like pay-per-view blood sport, posting screenshots of 0DTE options that expire worthless faster than a British prime minister. In Seoul, a grandmother live-blogs the event on AfreecaTV, overlaying Powell’s face with animated rainclouds whenever he mentions “restrictive for longer.” Her channel has more subscribers than the Financial Times.

The broader significance? FOMC live is the clearest proof we never really left the gold standard; we just replaced bullion with vibes. Every syllable is parsed for winks, nods, or the dreaded “data-dependent flexibility,” a phrase that roughly translates to “we haven’t the faintest clue, but we’ll sound decisive.” The global economy, a $100 trillion Jenga tower built on leveraged hope, wobbles or steadies depending on whether Powell’s tie skews dovish blue or hawkish crimson.

When the press conference ends, the world exhales, updates risk models, and schedules the next panic for six weeks hence. Somewhere in Sri Lanka, a tea picker who has never heard of the federal funds rate wonders why her weekly wage just bought 3% less rice. The answer lies in a livestream she will never watch, delivered by officials who will never visit her hillside, under a policy regime that insists it is “apolitical.”

And so the circus departs Washington, leaving only the faint smell of printer ink and the lingering sense that we have all, willingly or not, purchased season tickets to the same recurring nightmare—premium seating extra, popcorn priced in dollars, terms and conditions subject to change without notice.