Martine McCutcheon’s Second Bankruptcy: A Global Parable of Debt, Delusion, and Streaming Royalties

Martine McCutcheon and the Quiet Collapse of the Global Dream

By Our London Bureau Chief, still hung-over from the last royal wedding

LONDON — While COP summits wheeze out one final communique and Silicon Valley re-brands mass layoffs as “right-sizing,” a former East-End soap star has apparently been declared solvent again. Martine McCutcheon, once the luminous embodiment of Cool Britannia’s chirpiest delusions, has emerged from her second bankruptcy with the serene smile of a woman who knows the apocalypse will at least have a decent soundtrack. In any other week, the story would barely ripple beyond the Daily Mail’s sidebar of schadenfreude. Yet her small personal resurrection lands like a dark postcard from the edge of a planet that keeps refinancing its own nervous breakdown.

From Manila call-centres to Malibu juice bars, McCutcheon’s trajectory reads like an Ikea instruction sheet for late-stage capitalism: assemble fame, add fragrance diffusion line, lose coherence, file for insolvency, repeat. In 1997 she was Tiffany Mitchell, the barmaid who turned Albert Square into a geopolitical flashpoint for takeaway romance. By 2003 she was the Prime Minister’s tea girl in Love Actually, single-handedly jump-starting Britain’s service-sector fantasy that heartbreak could be outsourced to cue cards and a swelling string section. Somewhere between then and a gluten-free cookbook endorsed by a minor European royal, the wheels came off. Twice.

Observers in the emerging markets—where national bankruptcy is less a scandal than a weather forecast—watch the episode with the detached curiosity usually reserved for Florida sinkholes. “She is merely doing what our governments do every decade,” notes a Buenos Aires taxi driver who asked not to be identified because he still owes on a 2018 IMF breakfast. “Issue bonds, smile for cameras, pray for Netflix residuals.” In Lagos, McCutcheon’s name trends beside “debt restructuring” as university students craft memes comparing her to Nigeria’s naira: pretty, once stable, now floating on pure vibes.

The international significance lies not in the sums—£187,000 is what a mid-tier crypto rug-puller spends on artisanal oat milk—but in the narrative packaging. McCutcheon has become a living mood ring for the West’s refusal to acknowledge scale. Her Instagram grid, equal parts collagen powder and Buddhist aphorisms, is the aesthetic equivalent of quantitative easing: if you filter it hard enough, insolvency looks like self-care. Across the G7, ageing millennials recognise the syndrome: we were promised eternal relevance and got subscription-based hair vitamins instead.

Credit the global streaming hydra for keeping her commercially undead. Every time a bored teenager in Jakarta binges Love Actually in December, McCutcheon earns enough micro-royalties to keep the wolf from the door—or at least to buy the wolf a starter flat in Slough. This is the twenty-first-century safety net: intellectual property as pension plan. As OECD birth rates plummet, nations may soon issue citizens a residual rights portfolio at birth—your dividend statement arrives alongside your social-security number.

Meanwhile, the British establishment that once anointed her “the people’s sweetheart” now treats her like an embarrassing tattoo acquired during a stag weekend in Faliraki. Tabloids oscillate between pity and predation, a dynamic familiar to anyone who has watched the bond market discuss Argentina. One senses the same editors who eviscerated McCutcheon for debt are simultaneously lobbying Downing Street for tax relief on private-jet “wellness retreats.” The hypocrisy is so perfectly symmetrical it deserves its own Turner Prize installation—perhaps a looping projection of McCutcheon’s tears dissolving into Liz Truss’s mini-budget.

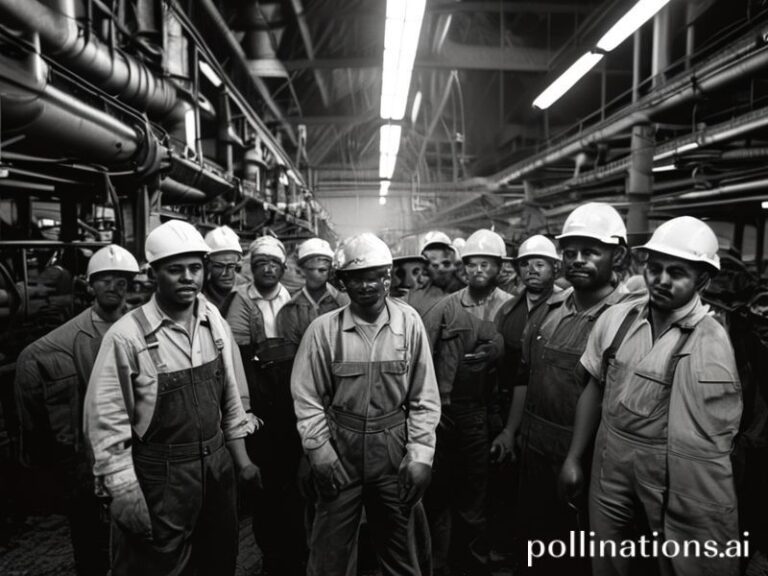

And yet, there she is on breakfast television, promoting a podcast about “manifesting abundance,” voice still husky enough to make a Swiss banker consider conversion. The planet burns, yields invert, but somewhere a former soap actress is proof that reinvention is the final commodity we haven’t managed to short. In that sense, Martine McCutcheon isn’t a footnote; she’s the canary still singing in the coal mine because the mine now offers Spotify Premium.

Conclusion: If civilisation is an unsecured loan taken out against the future, McCutcheon has merely reached the repayment phase a few cycles early. Her solvency is a reminder that the bill always arrives, dressed as either a bailiff or a brand partnership—sometimes both. Until the rest of us receive our own Chapter Whatever paperwork, we’ll keep streaming, scrolling, and pretending the interest rates on denial are still manageable. Cheers, Tiff.