The Great Savings Heist: Why NS&I Interest Rate Cuts Have the Internet Up in Arms

**The Great Savings Heist: Why NS&I Interest Rate Cuts Have the Internet in a Frenzy**

Alright, folks, gather ’round. We’ve got a financial drama unfolding that’s got more twists than a season of “Love Island” and more global impact than a K-pop album drop. I’m talking about the National Savings and Investments (NS&I) interest rate cuts that have sent savers worldwide into a tizzy. Let’s dive in, shall we?

**The Plot Thickens**

First, let’s set the scene. NS&I, the UK’s state-owned savings giant, decided to play Scrooge and slash interest rates on its popular savings accounts. We’re talking Premium Bonds, Income Bonds, and Direct Savers—all taking a hit. The move sparked a global conversation, with savers from London to Lahore scratching their heads and asking, “Why me?”

**Why the Fuss?**

You might be thinking, “It’s just a few percentage points. Chill out, people.” But here’s the thing: NS&I is like the trusty old friend who always pays you back. It’s backed by the UK government, so it’s seen as a safe bet. When it pulls the rug out from under savers, it’s like your best mate ghosting you on a group chat—it stings.

**Cultural Context: The Savings Saga**

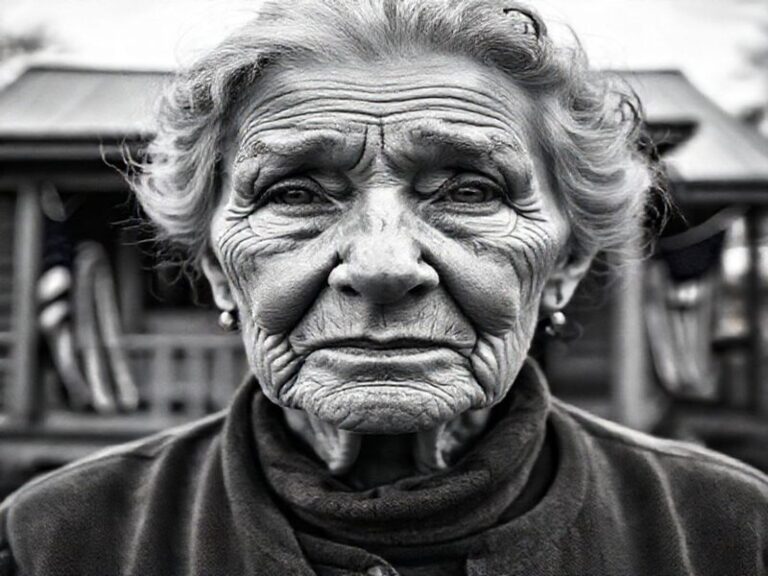

In the UK, NS&I is a household name. It’s the go-to for grandmas stashing away their pension and millennials trying to save for a house (good luck with that, by the way). The rate cuts hit hard because they’re a symbol of a broader trend: the global savings squeeze.

Think about it. Inflation is up, wages are stagnant, and now your savings account is paying less interest than a high school math test. It’s like being kicked while you’re down, then having someone steal your crutches.

**Social Impact: The Ripple Effect**

The NS&I rate cuts aren’t just about numbers on a screen. They’re about people’s lives. For some, it’s the difference between a comfortable retirement and counting pennies. For others, it’s the dream of homeownership slipping further away.

And let’s not forget the global impact. The UK might be an island, but its financial decisions send waves worldwide. Savers in other countries are watching, wondering if their own governments will follow suit. It’s like when one celebrity starts a trend, and suddenly everyone’s doing it—except this trend is about as popular as a cold shower.

**The Significance: More Than Meets the Eye**

So, why is this trending globally? Because it’s a microcosm of bigger issues. It’s about economic inequality, the cost of living crisis, and the struggle to save in an uncertain world. It’s about people feeling powerless in the face of big decisions made by faceless entities.

But it’s also about community. The NS&I rate cuts have sparked conversations, petitions, and even memes. People are coming together to vent, to support each other, and to demand change. It’s a reminder that even in the face of financial gloom, there’s power in unity.

**The Silver Lining**

Now, before you all start stockpiling canned goods and building bunkers, let’s remember: this isn’t the end of the world. It’s a challenge, yes, but also an opportunity. An opportunity to diversify your savings, to invest wisely, and to advocate for better financial policies.

And who knows? Maybe this will be the push we need to demand a fairer, more transparent financial system. After all, the people have the power—we just need to use it.

So, let’s keep the conversation going. Let’s support each other, share tips, and demand better. Because at the end of the day, our savings aren’t just numbers—they’re our futures.

And remember, folks: stay savvy, stay informed, and for the love of all that’s holy, start a pension.