Ford Stock’s Global Mood Swing: From Detroit Debt to Bolivian Lithium and German Wind Turbines

Ford Stock: The Blue Oval’s Global Mood Ring Turns Optimistically Glum

By Dave’s Locker International Desk

Detroit may still print the certificates, but Ford Motor Company’s share price these days is written in a dozen currencies, parsed in time zones from Tokyo to São Paulo, and interpreted by analysts who haven’t seen daylight since the Champagne socialists at Davos stopped serving free shrimp. When F ticked up 7 % last week on the back of “better-than-expected” quarterly numbers, traders in London popped lukewarm prosecco while their counterparts in Mumbai wondered whether the rally would survive the next monsoon of American political melodrama. The stock, in other words, has become a planetary mood ring: cheap enough to feel virtuous about buying, volatile enough to keep divorce lawyers on speed-dial.

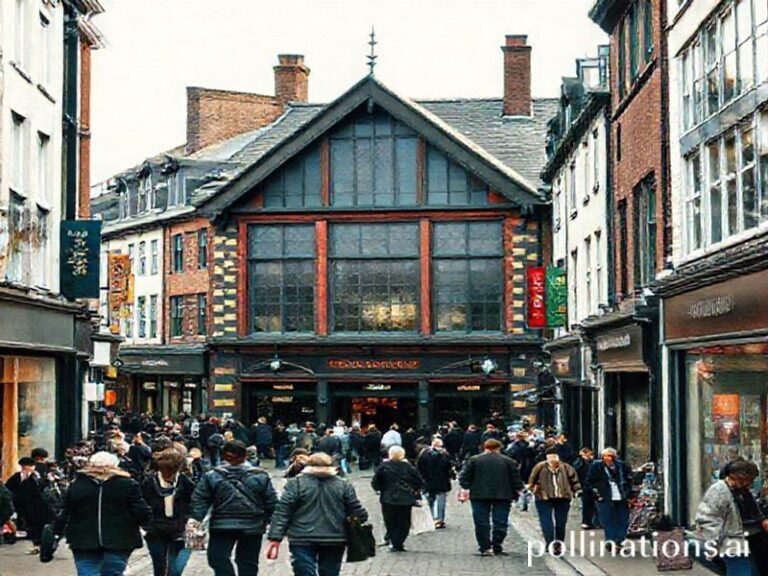

Start with the obvious: Ford is no longer your grandfather’s pension-fund pacifier. Yes, it still sells pickup trucks the size of small Balkan republics, but 43 % of its revenue now comes from places where people drive on the left, speak metric, and regard American exceptionalism as a charming drinking game. In China—where consumers are as loyal as house cats—Ford’s sales dipped 17 % last quarter, prompting the company to reassure investors it will “realign dealer inventories,” corporate argot for “bribe the local party boss with a Lincoln Nautilus.” Meanwhile, in Cologne, Ford’s all-electric Explorer rolls off a line powered by German wind turbines, which is convenient because German voters just elected a state government that thinks wind turbines are the devil’s eggbeaters. Global capitalism, everyone.

The EV pivot is where the plot thickens like British gravy. Ford has promised to spend US $50 billion on electrification by 2026, roughly the GDP of Slovenia, but the lithium required to make those batteries is mined in places with fewer labor laws than a pirate ship. Chilean activists recently held a protest so large it could be seen from the International Space Station—or from Jim Farley’s corner office if he ever looked up from the P&L. Analysts at Credit Suisse, who still wear suits even on Zoom, warn that every US $1,000 increase in battery costs slices 3 % off Ford’s margin. Translation: if you’re long Ford, you’re implicitly long Bolivian political stability, which is like betting your 401(k) on a soap opera marriage.

Then there is the small matter of American interest rates, which the Federal Reserve has hoisted so high they now double as weather balloons. Higher rates make it expensive to finance F-150s; they also make Ford’s US $88 billion debt pile look like a Jenga tower assembled by interns. In Jakarta, where car loans already cost more than a Balinese wedding, Ford’s local partner is experimenting with “pay-per-kilometer” subscriptions—a concept that sounds suspiciously like a taxi meter for your own driveway. Investors from Sydney to Singapore watch these experiments the way medieval peasants watched comets: fascinating, possibly apocalyptic.

And yet, contrarian money is sniffing around. Hedge funds in Tel Aviv like Ford’s 4.8 % dividend yield—better than Israeli bonds and significantly safer than parking cash in, say, a Russian fertilizer company. Sovereign wealth funds in Abu Dhabi, who measure risk in dynasties rather than quarters, have quietly built stakes on the thesis that the last company still building affordable V8s will enjoy a profitable zombiehood long after the last polar bear files for unemployment. Even the Norwegians, who divest from anything that might melt, have kept Ford in their ethical portfolio on the technicality that nobody has proven F-150s actually cause existential dread.

So what does it all mean? Ford’s stock is less a bet on Detroit engineering than a referendum on humanity’s ability to juggle geopolitics, climate guilt, consumer debt, and Elon Musk’s Twitter feed without dropping the ball. Every uptick is a small prayer that the world will muddle through; every sell-off is a reminder that muddling is not a strategy. Buy it for the dividend, hold it for the drama, and keep a bottle of something strong nearby for earnings calls. As the Romans didn’t quite say: caveat emptor, sed magis caveat mundus.