How One Wyoming Cowboy Sparked a Global Panic Over Blockchain-Stamped Cattle

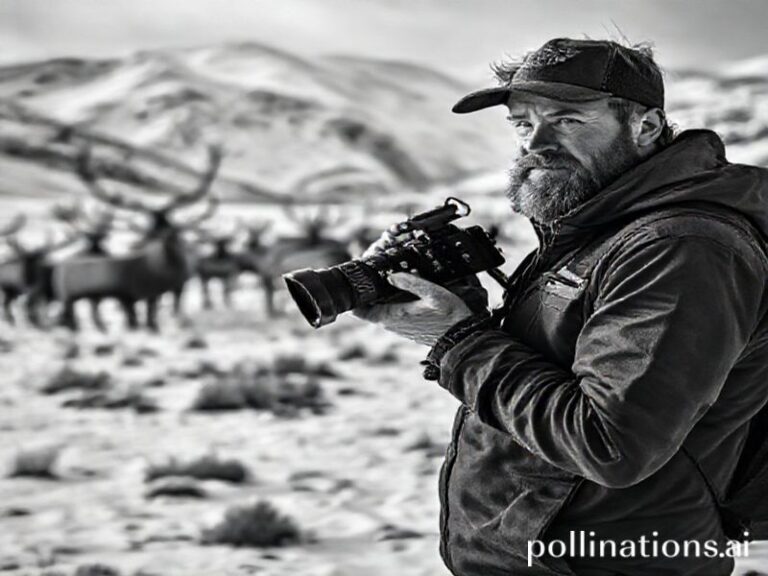

Travis Decker and the Quiet Art of Making the World Care About Wyoming

By “International” Correspondent (read: guy who once got stuck in Schiphol for nine hours)

COPENHAGEN—Somewhere between a NATO briefing on Arctic shipping lanes and the sixth refill of airport coffee that tastes like regret, I first heard the name Travis Decker whispered by a Danish cyber-diplomat who swore he’d “re-balanced the global memetic economy.” Translation: a 29-year-old cattle-branding consultant from Laramie just convinced four continents to argue about whether a QR code burned into a cow’s hide constitutes animal abuse or performance art.

Yes, really.

Decker—equal parts rancher, part-time philosophy grad, and full-time irritant to every regulatory body that still uses fax machines—has managed to turn the planet’s attention toward a state most people only remember exists when a Tinder date says they’re “from Cheyenne.” His crime? Launching “Branded Futures,” a blockchain-adjacent start-up that lets investors purchase fractional ownership of cattle via non-fungible brands. Each steer gets a unique scannable scar linking to a smart contract. Think Pokémon Go, except the creatures weigh 1,400 pounds and eventually become Wagyu sliders in Dubai.

Within 48 hours of launch, the South China Morning Post fretted about “American agricultural imperialism,” the Guardian dispatched a vegan podcaster to Wyoming on a carbon-offset guilt trip, and a Brazilian agri-giant filed an emergency WTO complaint claiming Decker is “weaponizing pastoral nostalgia.” Meanwhile, the steers—unconsulted as usual—continue chewing cud, blissfully unaware they’re now collateral in a proxy war between decentralized finance evangelists and people who still write checks at the feed store.

International implications? Plentiful. Argentinian ranchers, already jumpy after last year’s peso tango, fear Decker’s model will normalize “livestock securitization,” driving up the price of alfalfa faster than you can say “commodity super-cycle.” In Kenya, a Maasai WhatsApp group debated whether the scheme is neo-colonial branding—literally—or a clever leapfrog over traditional banking. And in Brussels, an EU subcommittee on “Digital Bovine Identity” scheduled emergency hearings, presumably right after they finish regulating toaster darkness settings.

The dark punchline, of course, is that Decker isn’t some Bond villain petting a Holstein in a volcano lair. He’s just a guy who noticed three things: (1) Gen-Z investors will buy anything if you call it “experiential agriculture,” (2) Wyoming has more cows than people, and (3) nobody trusts banks, but everybody trusts a cowboy with a soldering iron. Combine those ingredients and voilà—instant geopolitical ripple effect, served medium-rare.

Equally delicious is the moral panic oscillating between “Think of the calves!” and “Why didn’t I invest sooner?” French intellectuals—professional overthinkers since 1789—have declared the brands “post-modern pastoral trauma,” while Singaporean quant funds are back-calculating bovine volatility indexes. Even the Vatican issued a tepid statement reminding the faithful that “dominion over beasts does not imply treating them like volatile ETFs.” Somewhere, a Jesuit is Googling “staking rewards, but for steers.”

Yet beneath the absurdity lies a brittle truth: in a world where supply chains snap like cheap earbuds and crypto empires rise and fall faster than a TikTok dance, Decker’s cows have become oddly…stable. Their value isn’t pegged to a central bank but to grass, water, and the stubborn belief that people will still want hamburgers next quarter. That’s more than you can say for the Turkish lira.

So here we are. A lone cowboy with a propane torch has forced global regulators to debate the liquidity of heifers. The Anthropocene’s newest asset class walks on four legs and answers to “Bessie.” And if you listen closely across the international dateline, you can almost hear Klaus Schwab scribbling “Cow-Fi” into the next WEF agenda.

Conclusion? Travis Decker didn’t set out to upend the world order; he just wanted to monetize the family ranch without selling it to Bill Gates. In doing so, he proved a maxim darker than any steak: if you want to see humanity’s contradictions sizzling on the grill, follow the money—just don’t forget the branding iron.